How Does the IRS Verify the Solar Tax Credit (Form 5695)?

Written by Admin | Nov 20, 2025

What Is the Residential Clean Energy (Solar) Credit?

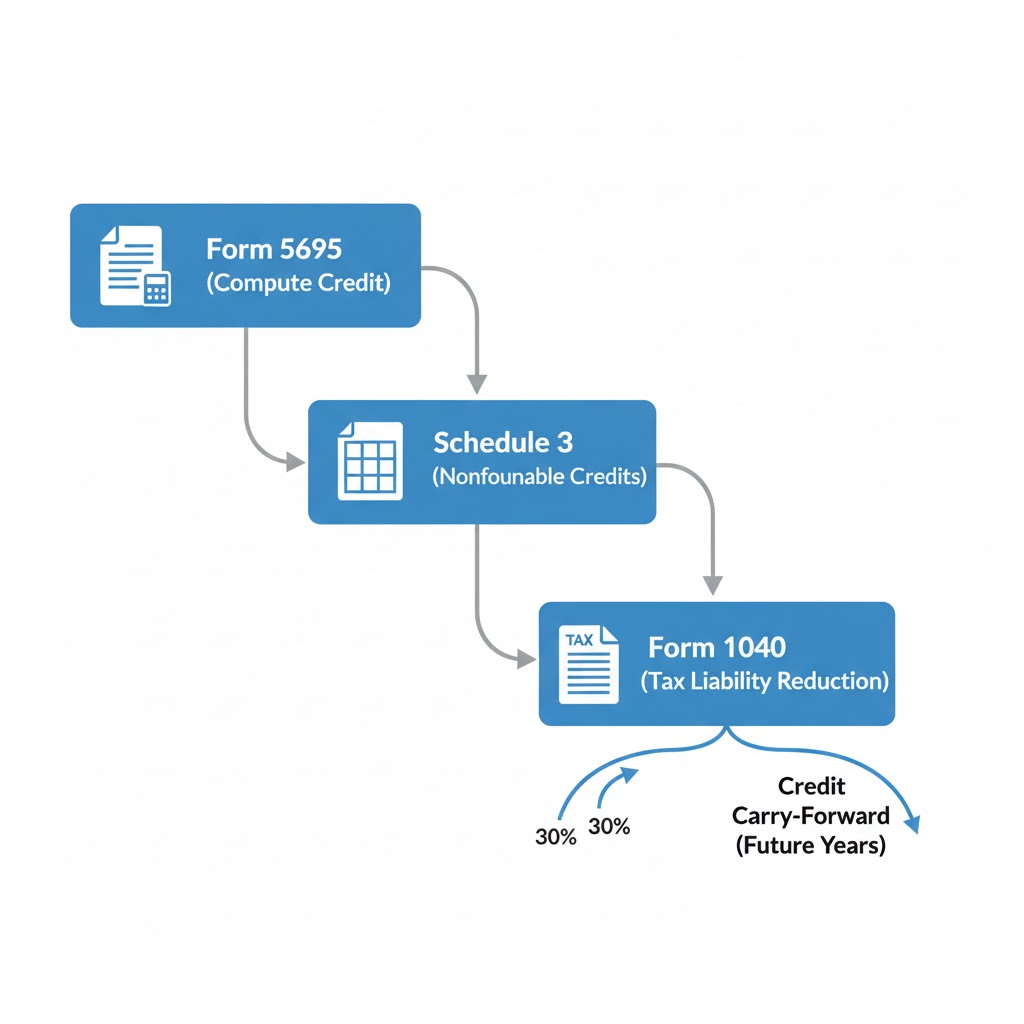

The Residential Clean Energy Credit (Internal Revenue Code §25D) is a non-refundable federal income-tax credit for homeowners who install qualifying clean-energy equipment—most commonly solar PV. It reduces your tax dollar-for-dollar (it’s not a deduction and not a rebate). You claim it on Form 5695, and the amount then flows to your Form 1040.

Credit Rate and Timeline (2022–2034)

Historical schedule (IRA 2022): 30% for property placed in service 2022–2032, phasing down to 26% in 2033 and 22% in 2034.

New law in 2025 (critical update): The One Big Beautiful Bill Act (Public Law 119-21) changed §25D timing. Per updated IRS FAQs and law summaries, expenditures for §25D property made after December 31, 2025 are no longer eligible—even if you prepaid earlier. In other words, to claim the residential clean-energy credit under current law, the installation must be completed (placed in service) by 12/31/2025. Some IRS pages still show the old 2034 schedule; rely on the newer IRS FAQ and enacted law for the 2025 cutoff.

Who Can Claim It (Owner-Occupied and Second Homes)

You must own the system and live in the home (it can be your primary or a second home). Landlords who don’t live there can’t claim §25D. The credit is non-refundable but you can carry forward any unused amount.

Qualifying Property (PV, Solar Water Heating, Battery Storage ≥3 kWh)

Eligible property includes solar electric (PV), solar water heaters (must meet SRCC or comparable state-endorsed certification), battery storage tech ≥3 kWh, geothermal heat pumps, small wind, and fuel cells (fuel cells have separate caps and main-home rules).

Eligible Costs (Equipment, Labor, Wiring, Permits)

You can include equipment and necessary labor for on-site preparation, assembly, original installation, and piping/wiring to interconnect the system to your home.

Ineligible Costs (Financing Charges, Warranties, Structural Roofing Only)

Interest and loan fees, extended warranties, and purely structural roofing (decking/rafters) don’t qualify. Solar shingles/tiles that both roof and generate electricity can qualify; ordinary roof work alone does not.

Glossary (Quick Definitions)

- Nonrefundable credit: Lowers your tax liability but won’t generate a refund by itself.

- Placed in service: The system is ready and available for use (often evidenced by final inspection or PTO).

- Purchase-price adjustment (basis reduction): Amounts (like certain rebates) that reduce your qualifying cost before calculating the credit.

- Correspondence exam: An IRS review conducted by mail where you send requested documents.

- SRCC: Solar Rating & Certification Corporation—commonly used certification for solar water heating.

- Schedule 3: The form where nonrefundable credits (including this one) flow before landing on your Form 1040.

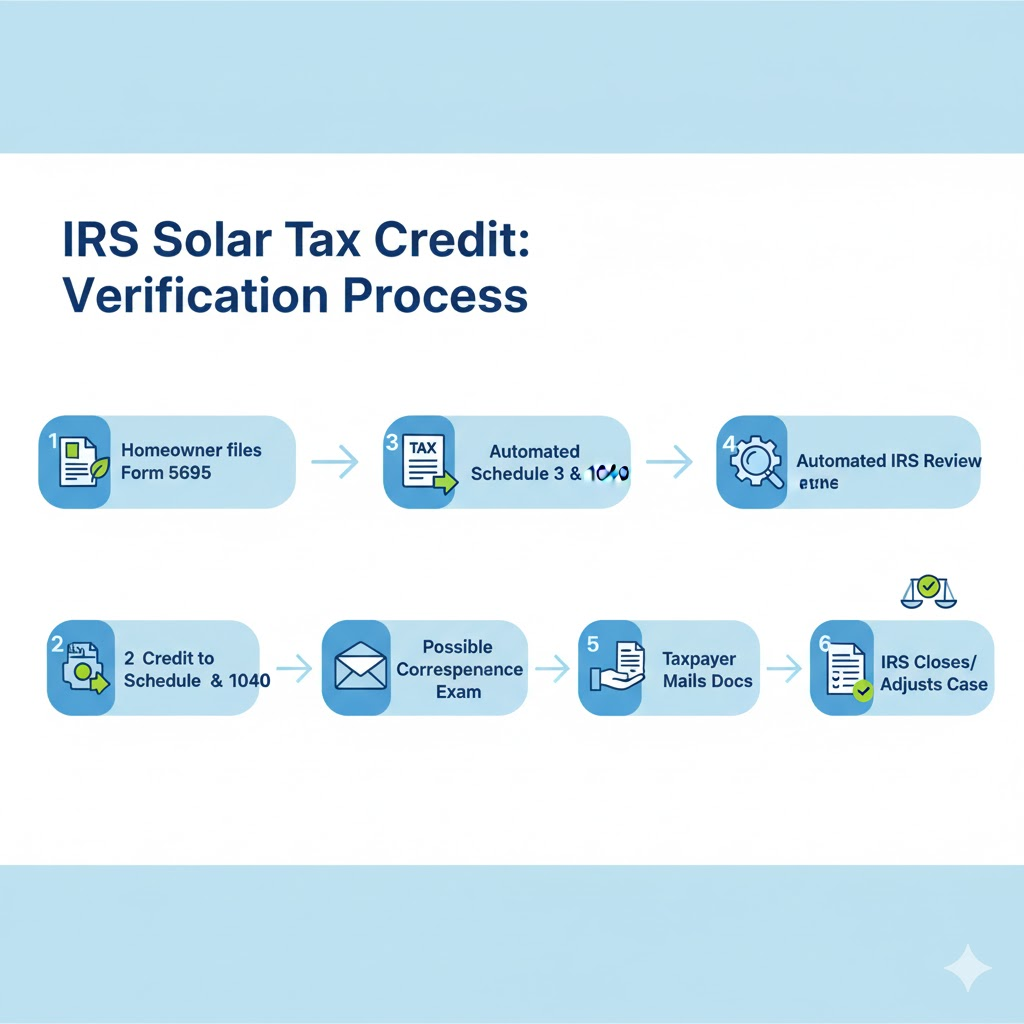

How the IRS Verifies Solar Credit Claims

The IRS doesn’t typically pre-inspect your home. Instead, it relies on your return, document review if requested, and standard audit programs. Keep your paperwork tight; it’s your best armor if you ever get a letter.

How the IRS verification process works (step-by-step)

- You file your return with Form 5695 showing eligible property and costs.

- The credit flows to Schedule 3, then to your Form 1040.

- The IRS runs automated checks; some returns get selected for correspondence exams.

- If selected, the IRS requests specific documents (invoices, proof of payment, permits/PTO, certifications).

- You respond by the deadline; the IRS reviews and closes the issue or follows up.

Return-Level Validation (Form 5695 → Schedule 3 → Form 1040)

You compute the §25D credit on Form 5695 (Part I). The allowed amount carries to Schedule 3 (Form 1040) as a nonrefundable credit, and then to your Form 1040. (For TY2024, see Schedule 3 “Residential energy credits” line references.)

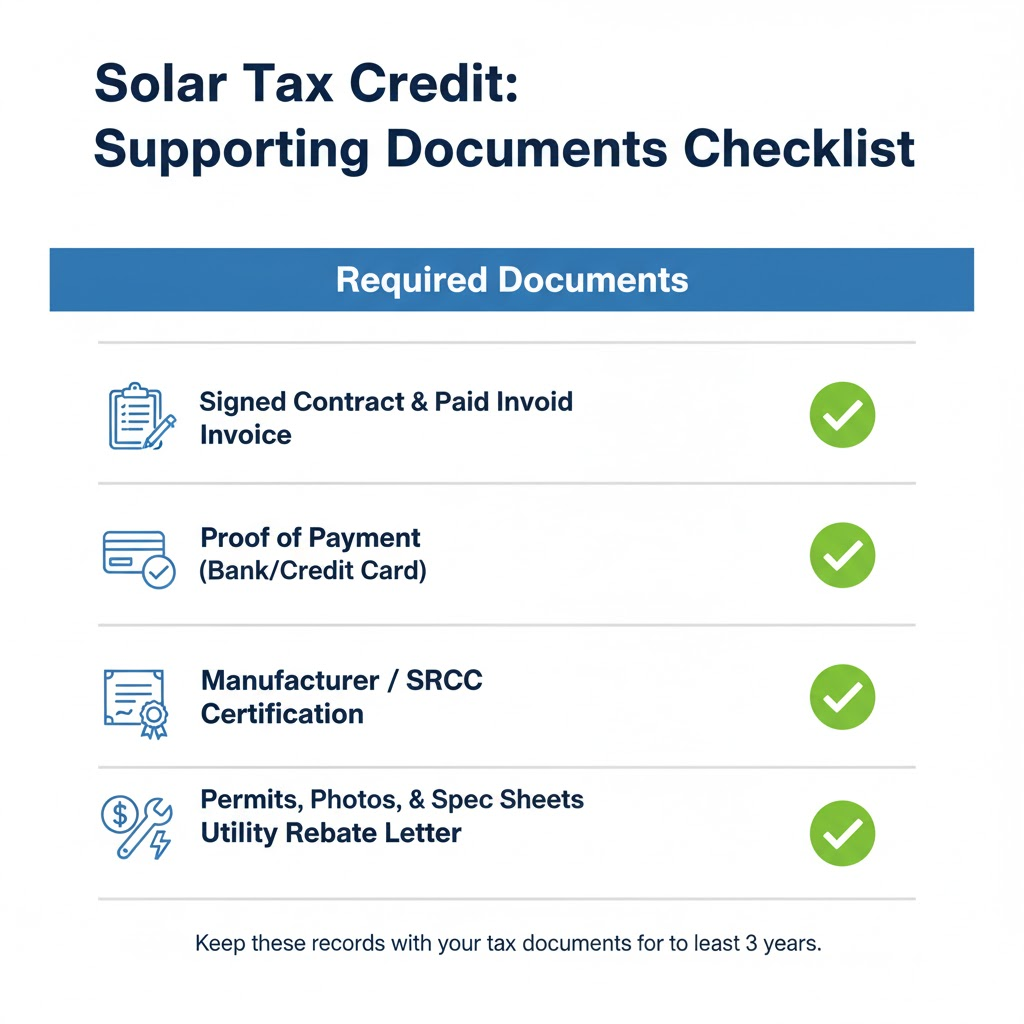

Documentation the IRS May Request

The IRS can request support by mail (correspondence exam) or other exam types. Be ready with:

Signed Contracts, Invoices, and Proof of Payment

Show the what, when, how much, and that you paid.

Placed-in-Service Evidence (Final Inspection, Interconnection)

To count for 2025, installation must be completed by 12/31/2025. Useful proof can include final inspection sign-off or utility interconnection/permission-to-operate letters that show when the system became ready and available for use. (IRS guidance: expenditures are treated as made when original installation is completed—prepayment alone doesn’t qualify.)

Certification Records (SRCC for Solar Water Heating; Manufacturer Statements)

For solar water heating, keep SRCC (or comparable state-endorsed) certification. It’s acceptable to keep manufacturer certifications for your records rather than attach them.

Permits, Spec Sheets, and Installation Photos/Records

System specs (including battery kWh), permit history, and photos can help substantiate eligibility and timing.

IRS Verification: Documents & What They Prove

| Document | What it proves | Where it’s used |

| Signed contract + paid invoice | Ownership, scope, cost, payment | Form 5695 cost basis support |

| Proof of payment (bank/CC) | That you actually paid | Substantiates invoice/contract |

| Final inspection or PTO/interconnection | “Placed in service” date | Eligibility for the 2025 deadline |

| Manufacturer/SRCC certification | Equipment eligibility (e.g., solar water heating) | Confirms qualifying property |

| Permits + photos/spec sheets | Installation details, capacity (e.g., ≥3 kWh battery) | Validates system characteristics |

| Utility rebate letter/installer credit memo | Basis reduction required for price-based subsidies | Adjusted cost before credit |

Basis Reductions for Rebates and Incentives

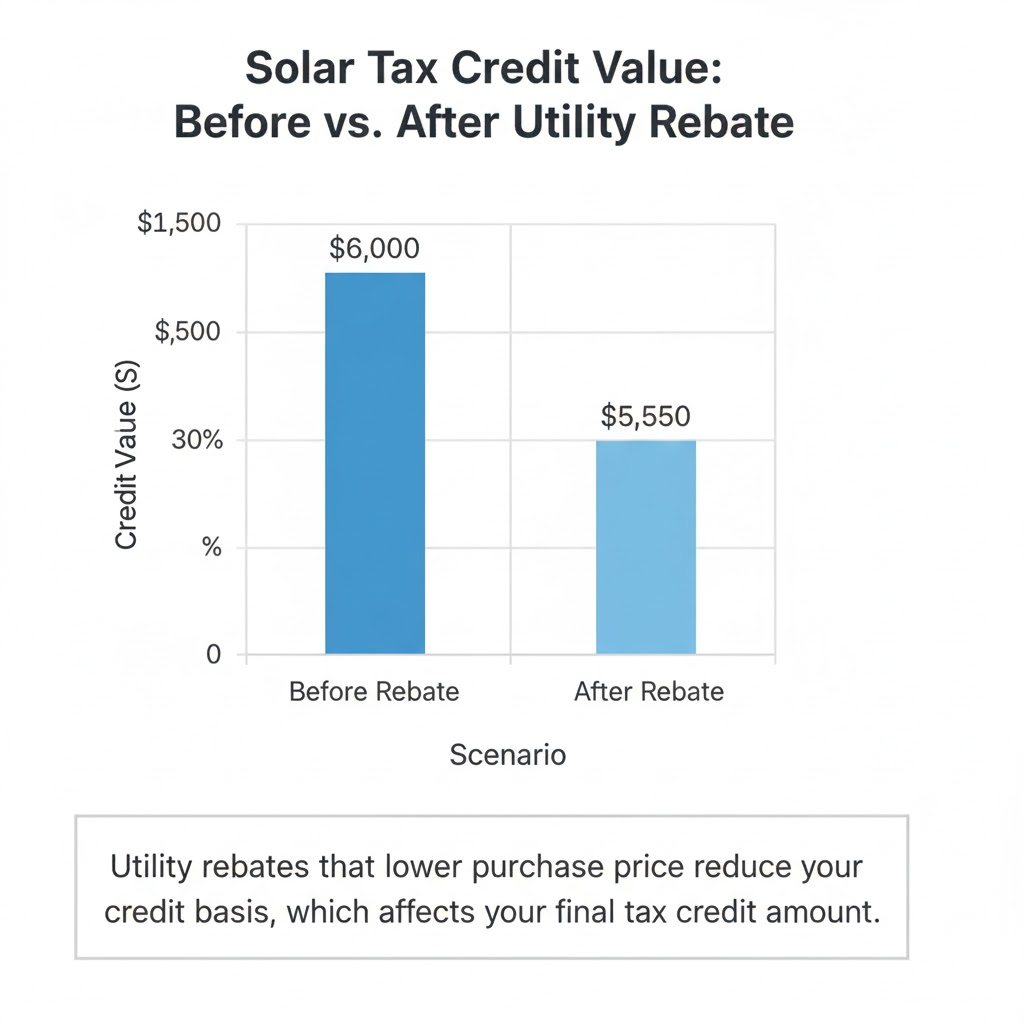

When you calculate the credit, subtract certain subsidies/rebates (e.g., public-utility rebates) from your qualified costs because they’re treated as purchase-price adjustments. Net-metering credits for electricity sold back generally don’t reduce the basis. Keep all incentive paperwork.

Example: $20,000 system − $1,500 utility rebate = $18,500 basis → 30% credit = $5,550.

Information Matching, Correspondence Exams, and Desk Audits

Most exams start with a letter asking for specific documents. The IRS uses document matching and correspondence examinations widely; if they need more, cases can escalate to office/field exams. Respond by the deadline and keep copies of everything.

Penalties and Accuracy-Related Consequences

Claiming costs that don’t qualify (or claiming for a leased system) can trigger accuracy-related penalties (20%); intentional fraud can bring far steeper penalties. Don’t risk it—document and report honestly.

If You Receive an IRS Letter (Troubleshooting)

- Read the notice carefully and note the response deadline.

- Gather invoices, proof of payment, permits, PTO, and any manufacturer certifications.

- Check that amounts on the notice match your filed return.

- If you need time, request an extension or call the number on the notice.

- Consider contacting your tax professional for help drafting a complete response.

Eligibility Checks the IRS Looks For

Ownership vs. Leases/PPAs

You must own the system. If it’s leased or under a PPA, you generally cannot claim §25D (the owner/lessor would claim commercial credits instead).

Residence Type (Primary, Second Home; Rental/Business Use Allocation)

You can claim it for homes you live in (primary or second home). Landlords who don’t reside there can’t. If your home is used ≥20% for business, your available credit is reduced to the personal-use share.

New vs. Used Property

New/first-use property only; used systems don’t qualify.

Battery-Only Claims After 2022 (≥3 kWh Capacity)

Standalone battery storage qualifies for expenses paid after Dec. 31, 2022, but it must be ≥3 kWh capacity. Keep spec sheets.

Joint Occupancy and Co-Owners

When multiple people occupy/own a home, each generally files their own Form 5695 and claims the portion they paid (special caps apply to fuel cells). Follow the joint-occupancy guidance in the instructions.

Common Filing Errors That Trigger IRS Notices

- Claiming Leased Systems

- Using Gross Costs Without Subtracting Rebate “Price Reductions”

- Including Ineligible Expenses (Interest, Extended Warranties)

- Wrong Tax Year or New Construction Missteps

- Mishandling Credit Carryforward

How to Claim the Credit Correctly

Completing Form 5695 (Part I) Step-by-Step

List qualified costs (equipment + eligible labor) by category.

Answer battery capacity question (must be ≥3 kWh if claiming).

Compute credit percentage for the year the item was placed in service.

Apply limitations and carryforward rules.

Case Study (realistic scenario)

A homeowner installed a PV + 10 kWh battery in September 2025. They kept the final inspection certificate dated 9/23/2025, PTO letter dated 9/27/2025, and paid invoice showing a $1,200 utility rebate credited on the bill. When they received an IRS letter requesting proof, they mailed copies of these documents. The IRS closed the case with no change because the documents clearly verified placed-in-service in 2025 and the basis reduction for the rebate.

Where the Credit Flows on Your Return

Form 5695 → Schedule 3 (Form 1040) → Form 1040 (non-refundable credits).

Recordkeeping: What to Keep and How Long

Keep records that support your credit—contracts, invoices, proof of payment, permits, certifications, interconnection letters, photos—until the statute of limitations closes (generally three years after filing, longer if you carry forward or if certain exceptions apply).

Special Situations

Mixed Personal/Business Use

If ≥20% of your home is for business, reduce the credit to the personal-use portion. (Businesses have separate energy credits; talk to your tax pro about coordination.)

Multi-Unit Properties and Shared Systems

If you occupy one unit in a multi-unit building and install a system that serves personal and non-personal spaces, claim only the personal-use share and keep allocation workpapers. (See joint-occupancy/shared-costs rules in the instructions.)

Second Homes and Vacation Properties

Second homes are eligible; allocate if you also rent the property part-year (personal-use share only). Keep usage logs if relevant.

Co-Owned or Jointly Occupied Homes

Each co-owner claims the portion they actually paid, subject to any applicable limits (notably for fuel cells).

Community Solar (Separately Located Projects)

If you purchase an interest in a community solar project located away from your home, eligibility can apply when the electricity credits are applied against your home’s usage and do not exceed it. Keep the program agreement and utility statements showing the credit allocation.

For Complex Returns (Advanced)

- Track carryforwards year-to-year with a simple worksheet.

- For multi-owner properties, keep proof of who paid what (and claim proportionally).

- If the home has mixed personal/business use, document the personal-use percentage.

- Coordinate §25D with other credits (e.g., §48 commercial) if any portion is business/property other than a dwelling unit.

Coordinating With State and Utility Incentives

Rebates That Reduce Basis vs. Taxable Incentives

Utility rebates/subsidies tied to purchase/installation generally reduce your qualifying cost basis for the federal credit.

Performance-based payments (e.g., production incentives) typically don’t reduce basis. Document everything and follow IRS FAQ language closely.

Timing and Documentation to Substantiate Net Costs

Save award letters, rebate checks, installer credits on invoices, and any 1099s so you can show how you derived net qualified costs.

Verification Checklist (Printable)

Before Installation

- Confirm ownership model (no lease/PPA).

- Get equipment specs showing battery ≥3 kWh if applicable.

- Ensure SRCC (or state-endorsed) certification for solar water heating.

After Installation

- Keep final inspection or interconnection/PTO letter showing the placed-in-service date (vital for the 12/31/2025 deadline).

- Keep paid invoices, proof of payment, permits, photos.

At Tax Filing Time

Attach Schedule 3 and file with Form 1040; retain all records ≥3 years. it, recycle it, and join the movement toward a more sustainable world—one small action at a time.

Complete Form 5695 accurately and reduce basis for eligible rebates/subsidies.

Frequent Ask Questions

James Parker

James Parker is an environmental expert, writer, and the founder of Envirose.com. Over the years, he has dedicated his work to studying sustainable practices, renewable energy solutions, and eco-conscious lifestyles. Through Envirose, he aims to inspire individuals to make small yet powerful changes in their daily lives that can collectively create a positive impact on the planet. When he’s not writing or researching, you’ll often find him outdoors, exploring nature and finding new ways to live in harmony with it.